Mindshare >> Data >> Tech ⚔️

How Wispr Flow became everyone's go-to AI voice app, their Netflix-style pricing, using monetization as a litmus test, and why they build their own LLMs. ✨

Wispr Flow is everyone’s favorite voice dictation app today. I’ve had friends tell me over coffee that they swear by it. Right there with ChatGPT, Claude, and Cursor.

Their Series A funding announcement noted that every single tier one venture fund in the valley uses Wispr Flow. Every so often there is an unprompted X post spelling out how much people love it.

They are also a part of Lenny Rachitsky’s curated subscription bundle of some of the most innovative AI tools — right alongside Superhuman and Replit.

That’s hard-won traction — especially in a space where Apple, Google, and frontier model makers are all making bets to no real avail.

Curious how Wispr got here, we sat down with co-founder and CEO Tanay Kothari.

What surfaced was the lesser-known backstory of their hardware beginnings, a view into their philosophy around pricing and retention, and Tanay’s obsession with building for everyone, not just the valley.

#1. How a contained pivot from hardware became Wispr Flow

When Wispr Flow started in 2021, it was with a bold bet to build a neural interface device that could translate speech into text even when you were surrounded by a crowd. Tanay got together a solid team with deep expertise in neuroscience, signal processing, and hardware.

Nothing short of an engineering feat, the device worked. But it didn’t land.

"We were solving a problem that hadn’t formed yet" Tanay shared. People weren’t adopting voice as a medium the way they had anticipated.

It was becoming clear that getting people to move to voice AND to a hardware device was too tall an order to take up, there was too much friction, partially because other voice interfaces like Siri and Alexa had under-delivered.

“The key thing I learned about products and hitting PMF over the years was you can change habits in people one habit at a time, but you can't get them to do a number of different things all at once.”

The team stayed at it, tinkering, stumbling upon the idea to innovate on the software layer.

It started as an internal project called “Project Flow” that could take your rambly thoughts and turn them into structured text. They opened up access for ten people and from there, it snowballed quickly.

“We initially had a group of 10 people using it, soon it was a group of 50 because they sent it to all of their friends and that just kept growing month over month.”

After 3 years of building on the problem, they started seeing market pull like never before, albeit for something they hadn’t planned on building.

It was clear, people wanted Flow. Soon enough, Tanay made the tough call to pause the hardware business and redirected all focus to software.

#2. Going in-house with models to control accuracy, latency, and other core experiences

The core dictation models are all built in-house at Wispr.

“GPT takes about three seconds to produce the first word, often referred to as time to first token, and then it takes a solid 20, 30 seconds to write the whole thing out.”

Tanay and the team had non-negotiables when it came to the quality of their responses. They knew quality was core to their user experience.

These non-negotiables were:

Accuracy: As a keyboard, Flow couldn’t hallucinate.

Latency: Dictation needed to feel instant, not lagged.

AI-speak: The output had to sound personal, not AI-churned.

They assessed the foundational models, but all of them failed to deliver on the bar Tanay wanted the output to be delivered at.

That kind of latency, Tanay knew, could become the achilles heel for Flow. The three years of their hardware past had also given them a clear sense of the kind of rigor they would need to crack adoption.

“We realized that people want to see the entire output in under a second. There is no API to a foundation model in the world that guarantees that. And the only way we make that promise to our users is by having the inference, the model, and everything else hosted on our side.”

#3. Mindshare is the only moat, not tech, not data

“I don't believe technology is a moat anymore. I think even data is not as strong of a moat as it used to be. The main moat that exists today in my opinion is mindshare and user loyalty.”

Wispr’s team works with one mandate: build an incredible amount of user love. This dictates their product decisions, messaging, brand, everything.

If you visit Wispr’s website, you’ll have a sense of what this means in action. The brand looks unique and recognizable, intentionally. Tanay believes in this so much that there is a dedicated awareness budget.

“We do performance marketing and we track the cost of acquisition and so on, but there's a budget we have allocated purely for awareness building and putting Flow in places where it is in front of millions of people.”

Another thing that Tanay is big on is “hitting the spot” with their marketing. Wispr’s marketing never uses jargon, talks like a friend, and focuses on driving an emotion home.

Interestingly enough, Tanay derives a lot of this philosophy from commodity consumer brands like alcohol, food, and apparel. A glimpse below:

Sensing an urgency to crack messaging, brand, and distribution, we asked Tanay what makes him so marketing-first as a technical founder, what he shared is a worthy reminder for every founder especially when the world is in a dizzying flux:

“The one thing that can beat a startup with an excellent team, working at an insanely fast pace is someone with a distribution advantage.”

This also underscores Tanay’s take on the controversial AI debate of margins, where he defers focus to mindshare again. While there is a ton of chatter about AI margins behaving poorly in comparison to the SaaS-era margins of 80%, Tanay pays just enough heed to it.

“We’ve seen moments where teams spend a quarter optimizing infra, only to see model pricing drop right after. We’d rather keep moving.”

Because Wispr trains and serves their own models, their gross margins are close to 90%. Some other AI startups are operating with a margin of sub-20%. His mindset is the same in both cases: to not over-focus on margins.

Pricing changes often. Models get cheaper. What feels expensive today might stop being so expensive three months from now, or might not even be needed.

#4. Determining staying power through a maniacal focus on retention

Early growth was never a reliable indicator for PMF, and with AI the adoption boom and bust has become even more common. Tanay was keenly aware of this from the beginning.

This is why Wispr’s team instead prioritised retention to determine their real staying power. “Were people coming back after the initial novelty wore off? Were they integrating the product into their routines?”

The team pulled in all retention tactics and notes, tracking their "smiley curve" for lapsed users, tracking their retention curve all the way up to week 26, and looking out for the health of their full funnel.

“I care about weekly active users because if you're getting a hundred people to try your product and only five are using it a week after, that to me is a failure of either the product, the marketing, the audience that it was targeted to and beyond.”

As different schools of thought, with different products and categories, some teams accept low retention, and just keep filling the top of the funnel. Others go deep on habits and optimize for long-term usage. Tanay is in the second camp:

"As a prosumer product, we lean toward retention. That’s what we monetize. If you go the other route, that’s fine — but you need to know how much you’re spending to acquire users and how many of them are actually staying."

#5. Why the point of your pricing model is to help users extract the most value from your product

“From a company perspective, I can see why usage-based makes sense. You’d think that your costs are usage based, so you should price it usage based. But if you make that decision without thinking deeply about it, it is lazy because you are putting the cognitive load on your user to figure out how to think about value from your product.”

Usage-based pricing is all the rage right now, but it wasn’t going to work for them for multiple reasons. The most obvious was general trust and familiarity. Tanay wanted to sell to “the average person”, not just the silicon valley.

"My dad is never going to understand token pricing. He shouldn’t have to."

Further he knew that paying monthly for a product is already a step away from the comfort zone for most people, and they didn't want to make it any more complicated than that. “I wanted them to think of this purchase the way they think of Netflix”.

Another challenge that Tanay discovered is the exploration barrier created by usage-based or consumption-based models, heavily underdiscussed right now.

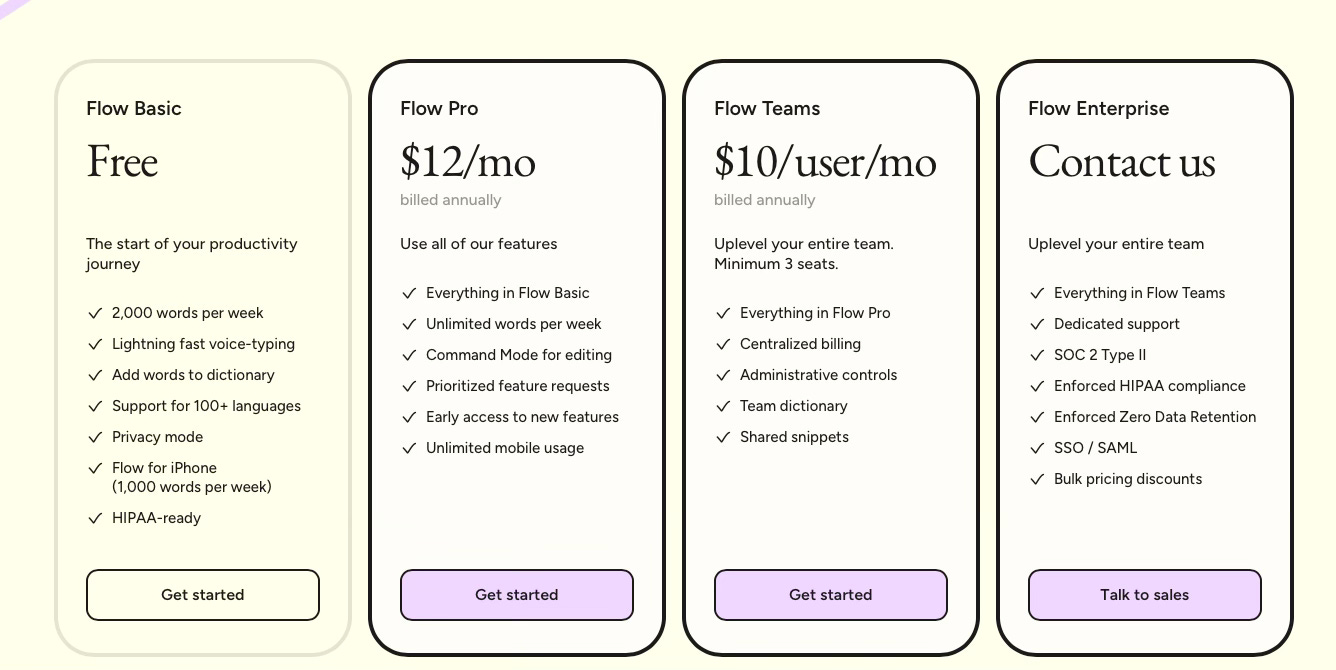

He has a hunch, one shared by our co-founder Krish Subramanian and hinted at by Sam Altman, that usage-based pricing can make users (especially with consumer focused products) too conscious of every action and penalise exploration of the product — incredibly counterproductive when you are trying to build a new habit. This is what their pricing page looks like as of September ’25:

“You get hooked to Netflix when you watch a bunch of things, you get hooked to Spotify when you listen to a bunch of songs, you get hooked to ChatGPT when you use it a bunch. By charging users for these actions, you are actually disincentivizing users from engaging with your product”

The challenge of inference costs is real and Tanay gets it. The solution, he proposes, is to figure it out internally on the level of your models and other technical efforts instead of pushing it on to the user.

Tanay closed his thoughts on the pricing model by reflecting on the recent changes that Cursor and Windsurf made, switching to usage-based:

“Cursor and Windsurf recently moved to usage-based and it makes sense because they tested flat and realised the changes that were needed. Plus they sell to developers. Developers get usage-based. Canva wouldn’t do that.”

Interestingly enough, even Cursor and Windsurf have had to face pushback from their customer base on this pricing change. Tanay’s point remains, pricing model decisions need to be made thoughtfully in tandem with the second-order effects he shared.

#6. Monetization as the realest indicator of PMF

“Unless you have a very strong exception to make, monetization is and always will be the best way to measure product-market fit.”

Monetization has always been a behemoth to tackle, now with AI it is all the more hairy. When to switch it on? What to make of it? What does it say about PMF?

Tanay offers a useful frame to tie PMF and monetization:

“PMF at the end of the day is the simple question of: did you solve a problem that somebody cares about and you can repeatedly get to other people like them?...If that’s a yes, then it is rational that people should want to give you a share of that value by paying.”

Monetization potential is so crucial at Wispr that whenever they are thinking about a new feature or a new product offering, monetization is one of the main tests to pass. There are a few ways the team goes about this:

Checking current behavior: Are they already paying for a tool that does what your new feature would do? If someone's spending $20/month on an existing solution, that's stronger validation than any survey response.

Direct ask: Simply asking: "Would you pay $5/month for this feature?" Tanay shares that they use this simple test to “assess if users are at all willing to pay for something.”

Beyond serving as a cold test of your product’s real value, at times, it can also show you how much people love you. Tanay recollects when they had first turned on monetization with a big launch, about half of their existing user base started paying right there.

Moreover, their emails were flooded with messages saying it was the best purchase someone had made. That level of reaction was a solid affirmation of the PMF Wispr had attained.

H/t to Tanay for taking the time to chat with us and share his lessons so candidly. 🙌

PMF /evals ◎ is just getting started. Tell us about how you're approaching AI-native building in the wild! Or what you’d like us to cover. Hit reply.

Brought to you by Chargebee. Chargebee helps AI-native, recurring revenue businesses scale with billing and monetization infrastructure built for speed, flexibility, and rapid iteration.

This my dad isn't going to understand is such a fantastic metric to test stuff. I've always loved it and am surprised its not used more often. Thanks for the interesting article.